Also a concessional GST rate of. HSN Code.

Fuel To Gst Centre State Relations May Emerge As A Rallying Point For Oppn Business Standard News

T his topic will take you through an end-to-end experience of how TallyERP 9 will help you comply with GST.

. File with us to win your taxes Ready to File. Smart Simple and 100 free filing. Petrol is non-taxable good since it is excluded from the levy of tax for the time being.

Tax Collected at Source or TCS -Example. KIND ATTENTION OF CENTRAL EXCISE PETROLEUM SECTOR TAXPAYERS. Using TallyERP 9 for GST Compliance TallyERP 9 Release 6 Download now.

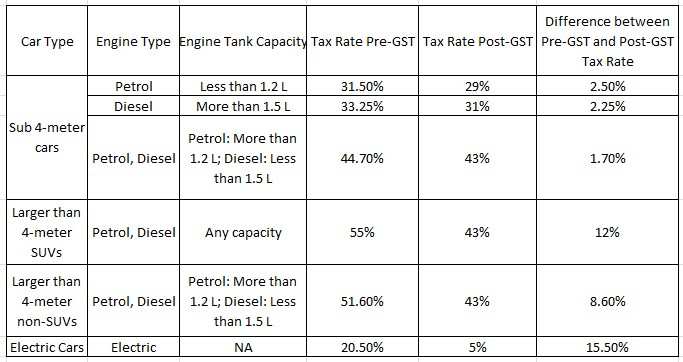

As per provisions of rule 138 14 of CGST Rules an e-way bill is not required to be generated when goods specified in notification no. This tax needs to be collected while transactions selling goods issuing a receipt of cash taken from the buyer or issuing a draft or cheque whichever mode is used preferred by the buyer. Subsequent to bringing cars under the GST regime the GST rate on cars has been fixed at 28 for all personal use vehicles featuring a petrol or diesel driven engine.

Thus the overall tax rate applicable to vehicles under GST ranges from 29 to 50. Bank accounts which have their PAN linked with Aadhaar will be able to receive refunds. HSN Code.

Not required to be generated. Any goods including capital goods. Tax levied on input goods input services or both.

30 Oct 2021 0531 PM. Free live chat facility. Criteria for levying HSN code.

Personalised Tax Filing experience. HSN Code GST Rate for. The introduction of the Goods and Services Tax GSTwith the promise to meet the challenges of legacy taxes multiple laws and varying rates across geographieswas a watershed moment in India.

Smart Simple and 100 free filing. Helpful tips for self filing. Revised the rate of tax in respect of petrol and diesel under forth schedule.

GST - Know about Goods and Services Tax in India with various types and benefits. In this article we will discuss the List of HSN Code with Tax Rates. File with us to win your taxes Ready to File.

Limited Liability PartnershipLLP Partnership Firm. A 4-digit HSN code is to be mentioned by taxpayers with a turnover of less than Rs5 crore. An HSN code needs to be declared up to 31st March 2021.

The items which come under this tax are mentioned under Section 206 C Income Tax Act 1961. Helpful tips for self filing. Taxpayers with a turnover of Rs5 crore and above will have to mention a 6-digit HSN code.

ISRO Antrix Corporation and New Space India Limite NSIL will. As per section 2 6 of the Act for Aggregate Turnover- aggregate turnover means the aggregate value of all taxable supplies excluding the value of inward supplies on which tax is payable by a person on reverse charge basis exempt supplies exports of goods or services or both and inter-State supplies of persons having the same Permanent Account Number to be. Notification for power enabling to Shri Rakesh Minhas IAS Officer dated 19-07-2019.

E A concessional GST rate of 12 applies to HSN code chapter 4414 instead of earlier 44140000 covering wooden frames having paintings photos mirrors etc. 192021 dated 28th December 2021. This rule came into effect on 1 April 2021.

Secondly If a business turnover is between 15-5 crore then 4 digit HSN code will be declared on the B2B invoice. ReTH65gcmBgCJ7k This Page is BLOCKED as it is using Iframes. Give us a call.

Circular regarding GST Trainning. Check GST rates registration returns certification and latest news on GST. However in addition to GST a composition cess is also applicable to cars over and above the GST Rate.

30 Oct 2021 0618 PM. Revised the rate of tax in respect of ATF under forth schedule. Personalised Tax Filing experience.

Input tax credit means credit of Input tax ie. So the seller acts as a. Is an e-way bill required to be generated in case of movement of exempt supplies.

PLEASE REFER ADVISORY 162022 DATED 030822 REGARDING ACCOUNTING HEAD CODE TO BE USED FOR PETROLEUM CRUDE AND AVIATION TURBINE FUEL FOR PAYMENT OF SAED Functionalities for appeal proceedings for Taxpayer appeal APL-01 and Tax Department Appeal APL-03 filed. Hirawadi Petrol Pump Vijay Park BRTS Ahmedabad - 382345 91 8866697535 91 8866697536 91 8866697537 91 8866697538 91 8866697539. If a business turnover is up to 15 crore then no HSN code is required.

Circular Regarding Furnish Bank Account Details and Aadhar Details dated 21. Free live chat facility. D Key changes are carried out to the description of goods exempt from GST vide the Central Tax Rate notification no.

Scope And Type Of Supplies Under Gst Taxmann

What If Petrol And Diesel Come Under Gst Regime In India Hostbooks

To Bring Petro Fuels Under Gst Bibek Debroy S Advice Is Worth Listening To Mint

Hsn Code List Gst Rate Finder Find Gst Rate Of All Hsn Codes Tax2win

The Use Of Tax Codes When Entering Transactions Exalt

Why Is The Automatic Calculation Of Taxes Sometimes Wrong How Can I Resolve An Event That Adds An Incorrect Fraction To The Tax Amount

Fuel To Gst Centre State Relations May Emerge As A Rallying Point For Oppn Business Standard News

If Petrol And Diesel Are Brought Under Gst They Ll Have To Be Taxed At More Than 100 Mint

Likely Revenue Loss Cited For Keeping Fuel Out Of Gst The Hindu

If Petrol And Diesel Are Brought Under Gst They Ll Have To Be Taxed At More Than 100 Mint

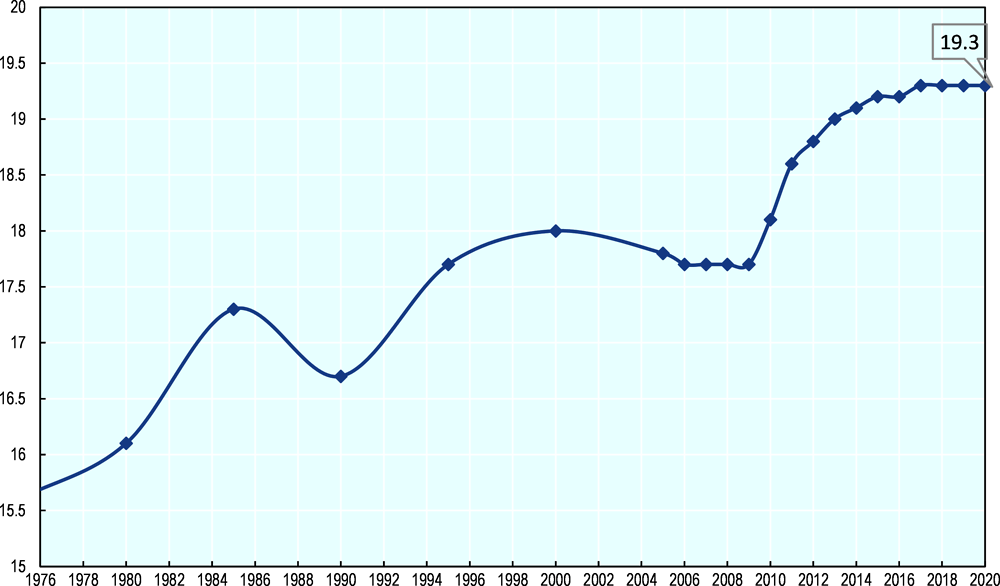

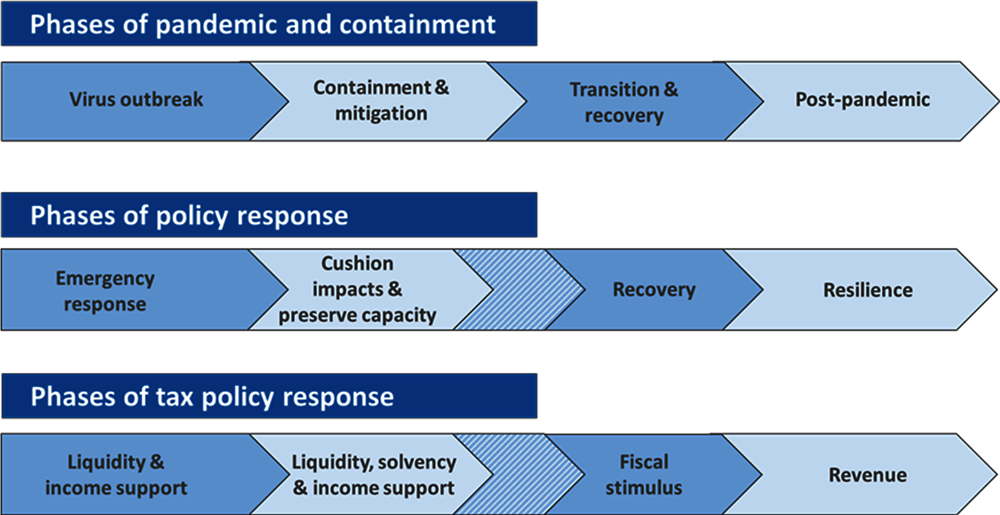

2 Value Added Taxes Main Features And Implementation Issues Consumption Tax Trends 2020 Vat Gst And Excise Rates Trends And Policy Issues Oecd Ilibrary

Auto Gst Rates What Are The Gst Rates On Automobiles In India Auto News Et Auto

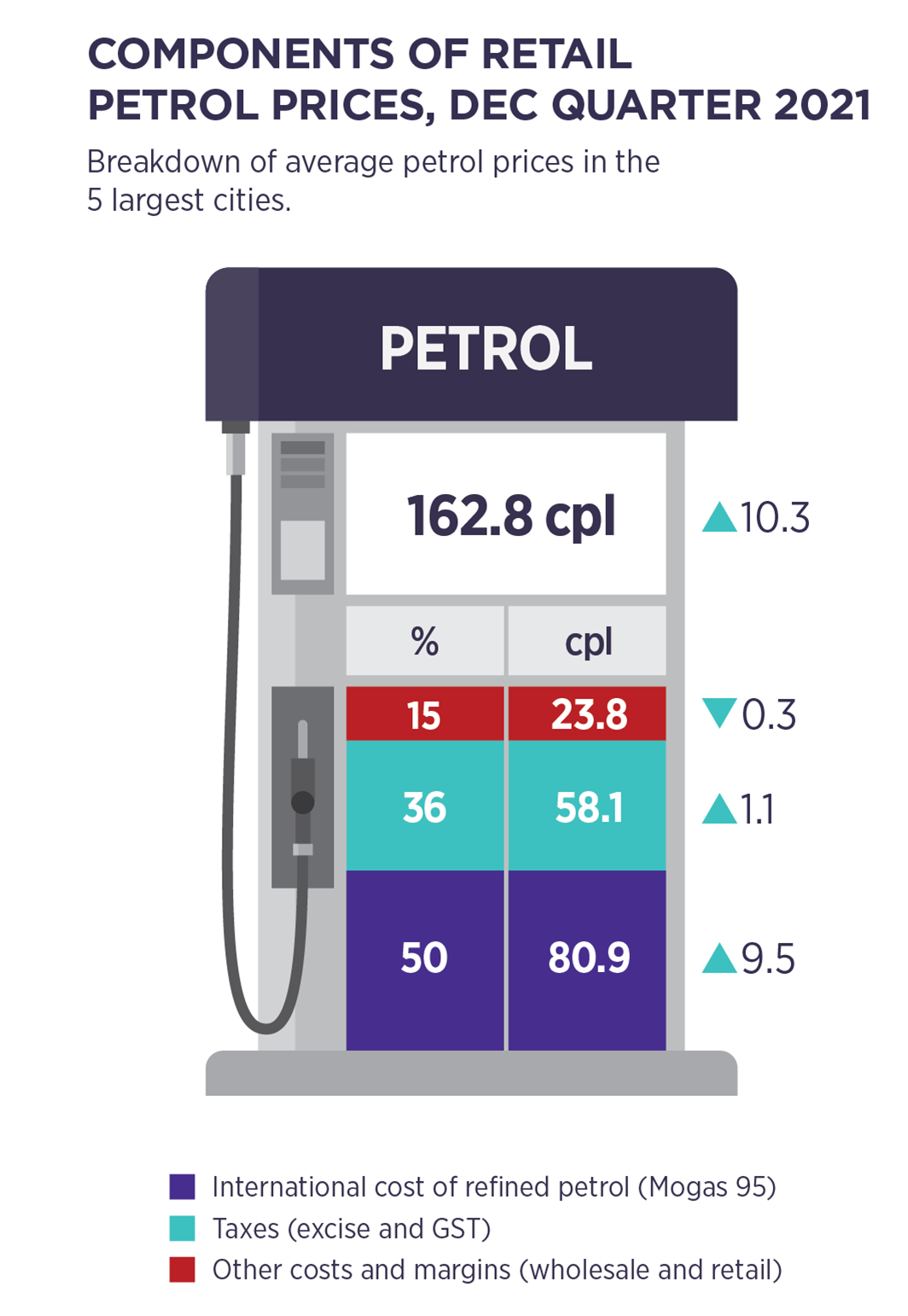

Accc To Monitor Petrol Prices Following Cut In Fuel Excise Accc

2 Value Added Taxes Main Features And Implementation Issues Consumption Tax Trends 2020 Vat Gst And Excise Rates Trends And Policy Issues Oecd Ilibrary